Walk into the new year with a financial plan in place

The Covid-19 pandemic brought most of our plans to a grinding halt. Individuals and families who had a financial plan in place went through a tricky time trying to realign their finances. For ones with no proper plan in place, it was a moment of awakening.

The pandemic may or may not have been the trigger for people, especially the young, to start thinking about saving and investing, but it surely gave this thought around financial literacy and planning a major push.

What is Financial Planning?

Financial planning for individuals and families means determining your immediate and future money goals, and figuring out a way for you to meet them. You can plan for the future by investing a part of your income diligently on a monthly basis. How much to invest is subjective, and depends on your financial requirements, your collective income and expenses, and the time period you have in mind to achieve your goals.

Why is Financial Planning Important for the Young?

Starting early or starting young has an advantage like no other when it comes to financial planning and investment. It gives you the benefit of time, which is crucial when you’re planning for financial goals like retirement, buying a house, children’s education, and so on.

When you start investing young, you can not only have the luxury to invest small amounts at a time, but you also reap the benefits of compounding. Take for example –

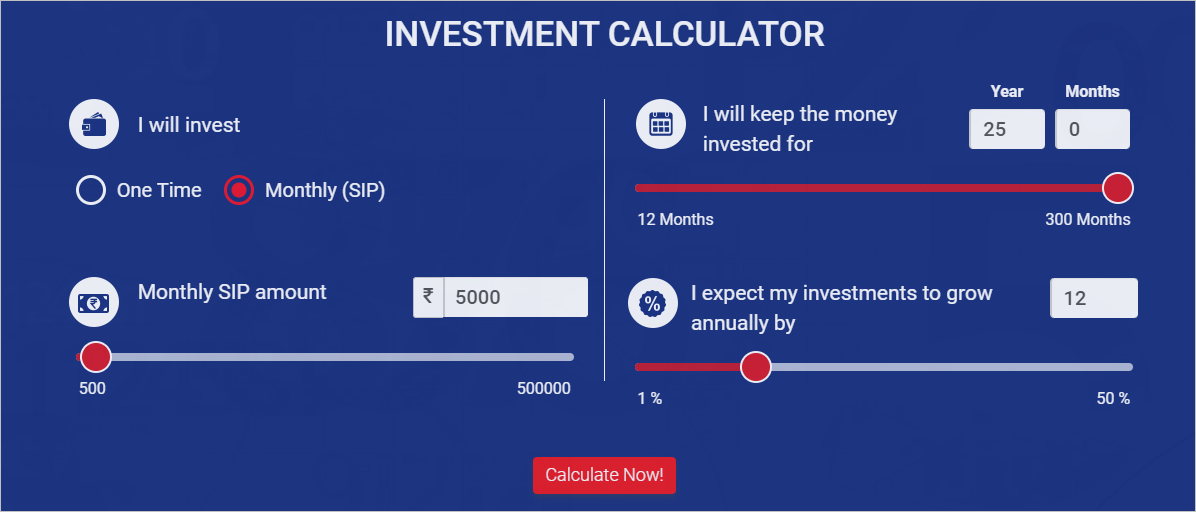

Example 1:

If you start investing Rs. 5,000 per month in a Mutual Funds SIP at the age of 25, your investment and return will total to approximately Rs. 94.88 lakhs at the age of 50. This calculation is based on the assumption that you will earn an average return of 12% per annum.

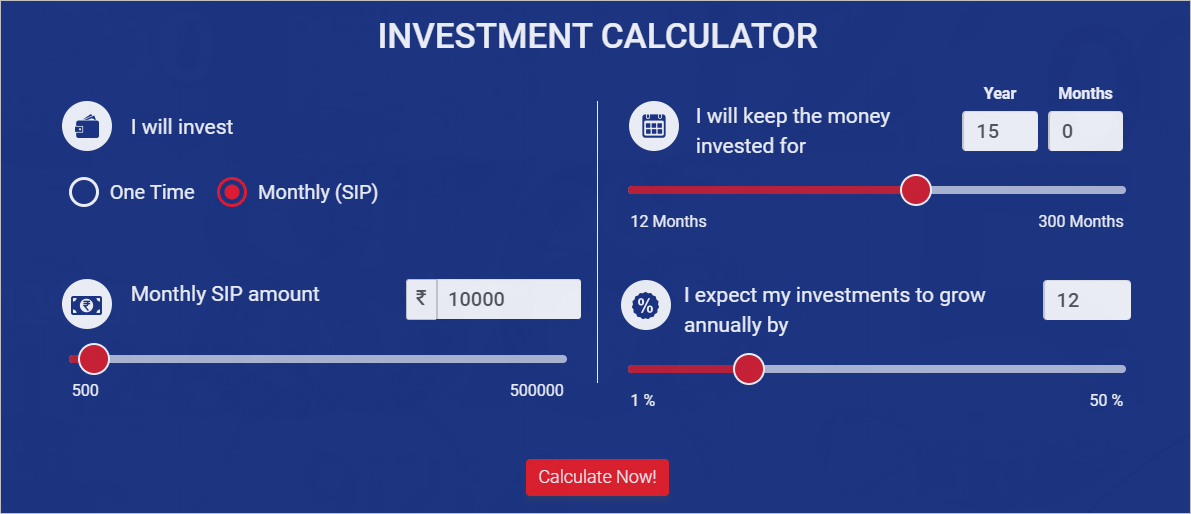

Example 2:

Alternatively, if you start investing Rs. 10,000 per month in a Mutual Funds SIP at the age of 35, your investment and return will total to approximately Rs. 50.46 lakh at the age of 50. This calculation is based on the assumption that you will earn an average return of 12% per annum.

See the difference? Starting early lets you start small, with bigger returns by the time you retire. Starting late with double of the amount of monthly investment, however, will still earn you comparatively smaller returns. Something to think about, right?

Usually, your understanding about money and its management flows from your most trusted sources, that is, your family. The important thing to remember is that your financial plan has to align with your goals and requirements, hence it can be quite different from your parents’ financial plan.

When it comes to financial planning and developing an awareness around it, this old proverb holds more than true:

“The best time to plant a tree was 20 years ago. The second-best time is now.”

As we walk into another, hopefully better year, here are 5 golden tips about financial planning to help you manage your money better.

1. Start Now

We cannot stress enough on how much we mean it when we say, start now! The pandemic has been the first of its kind crisis that the younger generation has faced. The couple of months of lockdown put unexpected constraints on everybody’s earnings, and that in turn helped stress heavily on the need to have a financial backup for such unforeseen calamities. If the pandemic wasn’t a good-enough wake up call for you, here’s your sign to start taking your financial plan seriously. With several digital investment tools in the market, your job today is actually quick and stress-free.

2. Invest For Specific Goals

Investing without a set goal in mind can only get you so far. Goals give a certain direction to your financial plans, help you break down your financial needs into achievable targets and put things into perspective. For example, your financial goals can be long term goals like retirement, children’s education, buying a house property, or even short term goals like upgrading your car, an annual vacation, a shopping fund, and so on.

3. Always Have An Emergency Fund

An emergency fund is supposed to be your reserve of money for a rainy day. For example, many people stopped receiving their salaries during the first lockdown of the pandemic, many had their salaries slashed. However, they were still expected to pay back their loans, EMIs, utility bills, pay for essential expenses & so on. An emergency fund always comes to your rescue when for whatever reason, your income levels aren’t at par with your living expenses.

At the very least, it is advisable to have your 6-month salary/earnings as an emergency fund. You can always keep this money aside in a debt fund, or an RBL Bank fixed deposit / recurring deposits. The key is to keep this money in a less risky form of investment to avoid incurring any losses.

4. Invest for the Long Term

Barring your emergency fund, your focus should ideally be to invest for at least 5-10 years to begin with. As we have already seen, time is of great importance when it comes to investing and building your wealth, and long-term investments give you sufficient time to achieve your financial goals slowly and steadily. Starting early, investing small and investing for the long run also protects your money against extreme losses, and in situations like an economic lockdown, you still manage to be in a good place even when you cannot invest for the time being.

5. Diversify your Investments

“Never put all your eggs in one basket” holds true for investing. Placing your money in different forms of investments that offer different levels of return and risk helps you protect it from the volatility of the market. It is always advisable to get professional help in assessing your financial goals and arriving at a financial plan that suits you to the T.

The Bottom Line

Only under 5% of Indians invest their money in the equities market even with a steady rise in financial literacy in India. One of the main reasons for it is the fear around investing (what if I incur huge losses?), and the myth that you need a lot of money to start investing, even the notion that you have a lot of time before you have to start investing. Well, for one, you can start investing with as little as Rs. 100, and that’s something you can easily afford, right? As for time, with investing it’s always the more, the better!

Blog

Blog Blog

Blog

Comments

No comments yet.