How to Open a Digital Savings Account?

In the past, opening a savings account required spending hours in huge lines and filling up various documents. Digitalization has allowed the world to shift all kinds of financial transactions online. It also means you no longer need to go to the bank to open a savings account. Now, you have the convenience of opening a Digital Savings Account from your home, making it one of the fastest and most hassle-free method of opening a savings account.

Digital Savings Account ensures a paperless, quick, and safe way to open an account. The only documents required for opening an account are your Aadhaar and Permanent Account Number (PAN) card. Account holders can also avail banking services like fast transfers, phone banking, SMS banking, etc. with the help of a Digital Savings Account.

Every account holder, whether a college student or a working adult, benefits from opening a Digital Savings Account. Below are some of the major benefits listed for you:

- More the savings, better the earnings. With a Digital Savings Account, you can get the benefits of a higher interest rate.

- It’s quite a hassle to visit the bank every time, to know the status of your funds, and fill out documents to transfer funds. With this account, you get easy access to your funds, anytime, anywhere.

- This account is completely safe, secure, and easy to use.

- Conveniently track expenses and pay monthly utility bills with ease. Even better, you can set up your online savings account to automatically pay your bills.

- With a digital savings account, you can make unlimited free transfers. RTGS (Real-Time Gross Settlement) is used to transfer large amount of money, such as over INR 2 lakhs. The fastest way is Immediate Payment Service (IMPS), where money can be transferred all seven days of the week, anytime and, even on holidays. Another alternative is National Electronic Fund Transfer (NEFT), which is available 24×7.

- Once you open a Digital Savings Account, you will be issued a virtual debit card. You can usethis card to scan and pay, shop online, or transfer money.

Also, read about how Digital Savings Account differs from Regular Savings Account.

Step-by-step guide to open a Digital Savings Account

Opening a Digital Savings Account is simple. Here is a step-by-step guide followed by most financial institutions:

Step 1: Choose the bank you prefer to open your account with. Take time to research the interest rate offered, account fees, additional charges, minimum balance requirement, eligibility criteria, and level of support.

Step 2: Check the bank’s website or mobile application to understand how to easily open an account.

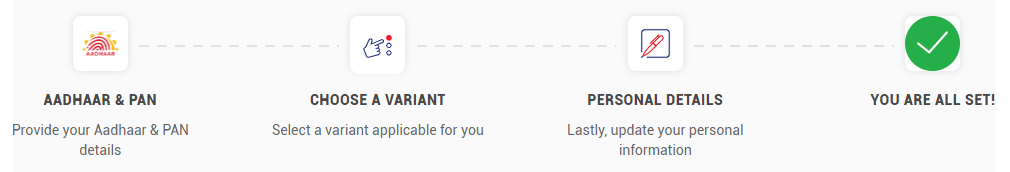

Step 3: Fill in the online form available by giving your exact details, such as name, date of birth, phone number, email ID, etc. By completing the online account opening form found on a bank’s website or mobile banking application, you can start a digital savings account right away.

Remember that the general eligibility requirement to open a digital savings account is that individuals must be above 18 years of age and must be an Indian resident. Most banks also provide Digital Savings Accounts to customers who are new to banking or who don’t already have a previously created account.

Step 4: Submit the required documents online for bank verification. You only need to submit PAN Card and Aadhaar Card details online. The Aadhaar-based One-Time Password (OTP) authentication mechanism allows banks to open a Digital Savings Account for customers immediately, following RBI regulations. Keep the documents handy before planning to open an account.

Step 5: Complete the KYC (Know Your Customer) process. Banks are required to undertake this procedure before allowing you to register an online account, which includes Video KYC if necessary (To avail additional benefits)

Step 6: After completing the KYC procedure, you will be given the login information for your online bank account. Depending on the bank, this may take a few hours or a few days. Using these credentials, you can then access your Digital Savings Account. It’s that simple.

What is Video KYC (Know Your Customer)?

Video Know Your Customer (VKYC) is an audio-visual interaction. In which a representative from RBL Bank will verify and capture your PAN card and signature. It will take a few minutes only. Now, you are all set! It is simple and hassle-free to open a Digital Savings Account with RBL Bank.

How to easily open a Digital Savings Account with RBL Bank?

The lengthy process of opening a savings account is no longer necessary. You can access the bank from the comfort of your home with a Digital Savings Account from RBL Bank.

You only need your Aadhaar and PAN number to start a Digital Savings Account. There are numerous ways an RBL Bank Digital Savings Account will simplify your life. With the RBL Bank Digital Savings Bank Account, you receive the following: No charges on non-maintenance of balances*

- Instant and paperless

- Higher interest rates

- Anytime banking

- Virtual Debit Card

*Just set up an SIP or RD for a minimum amount of Rs. 2,000 (Applicable only on Digital Savings Account – Prime)

Steps to register on RBL MoBank App:

Step 1: Visit Google Play Store or iOS App Store to download the App

Step 2: Open the App and register using your preferred mode

Step 3: Verify with OTP and start using the App

Pro-tip: You need to maintain a monthly balance of INR 5,000 in your Digital Savings Account and it will be INR 10,000 in case you have opened Woman’s First Savings Account. You can also make your Prime Savings Account a zero-balance account. To convert into a Zero Balance Account, create a Systematic Investment Plan (SIP) or Recurring Deposit (RD) of a minimum INR 2,000 or more.

Digitalization has made banking hassle-free by eliminating the troublesome routine of waiting for a bank statement or updating a passbook. The benefits of having a Digital Savings Account include instant cash-back offers, coupons and discounts for various online transactions.

You can open a Digital Savings Account in one of two ways: by visiting our website or by installing the RBL MoBank App. In both cases, you must provide your mobile phone number, your Aadhaar, and your PAN number. A virtual debit card is included that can be used for online payments and purchases, much like physical debit cards. The usage of this debit card is possible for online shopping, recharges, scan-and-pay at retail locations, and bill payment.

To view any transactions that have taken place in your account, simply log onto RBL MoBank App, whenever you wish.

We have strong security measures in place to guarantee the security of your account. Two-factor authentication and other security measures ensure that only you can access your account.

Go ahead and open an RBL Bank Digital Savings Account right away.

Blog

Blog Blog

Blog

Comments

No comments yet.