Systematic Investment Plan

What Is Systematic Investment Plan (SIP)?

-

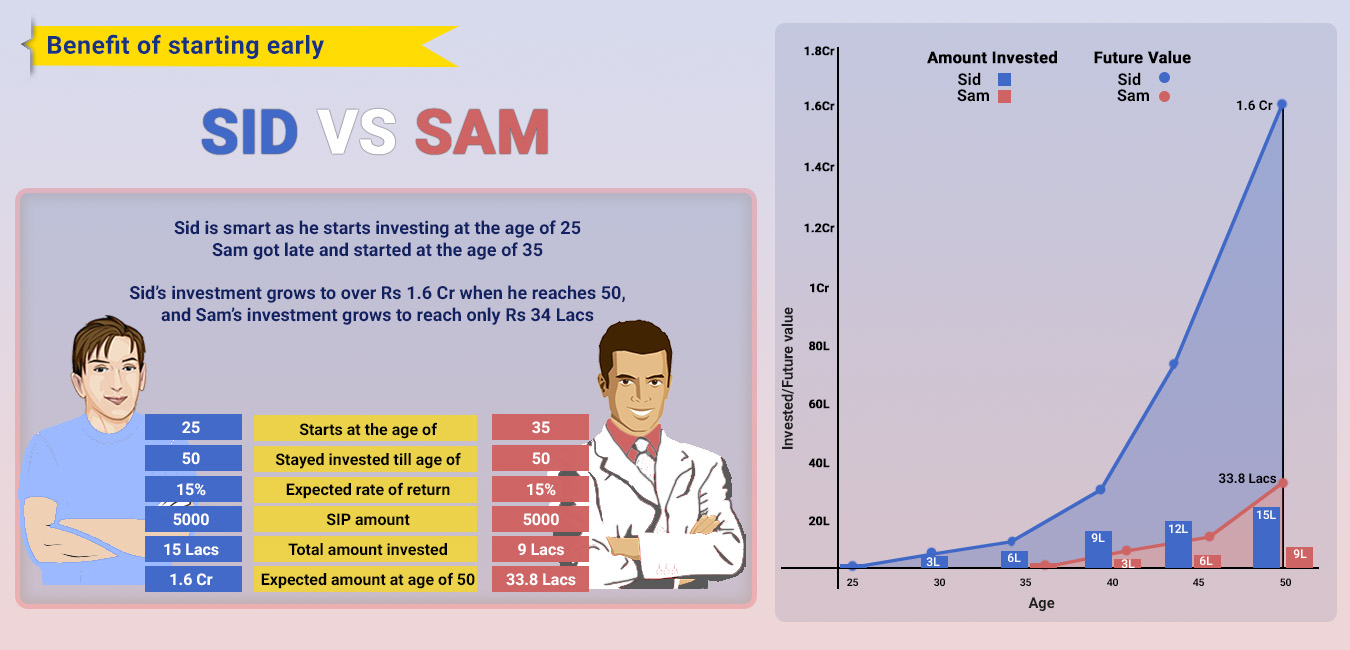

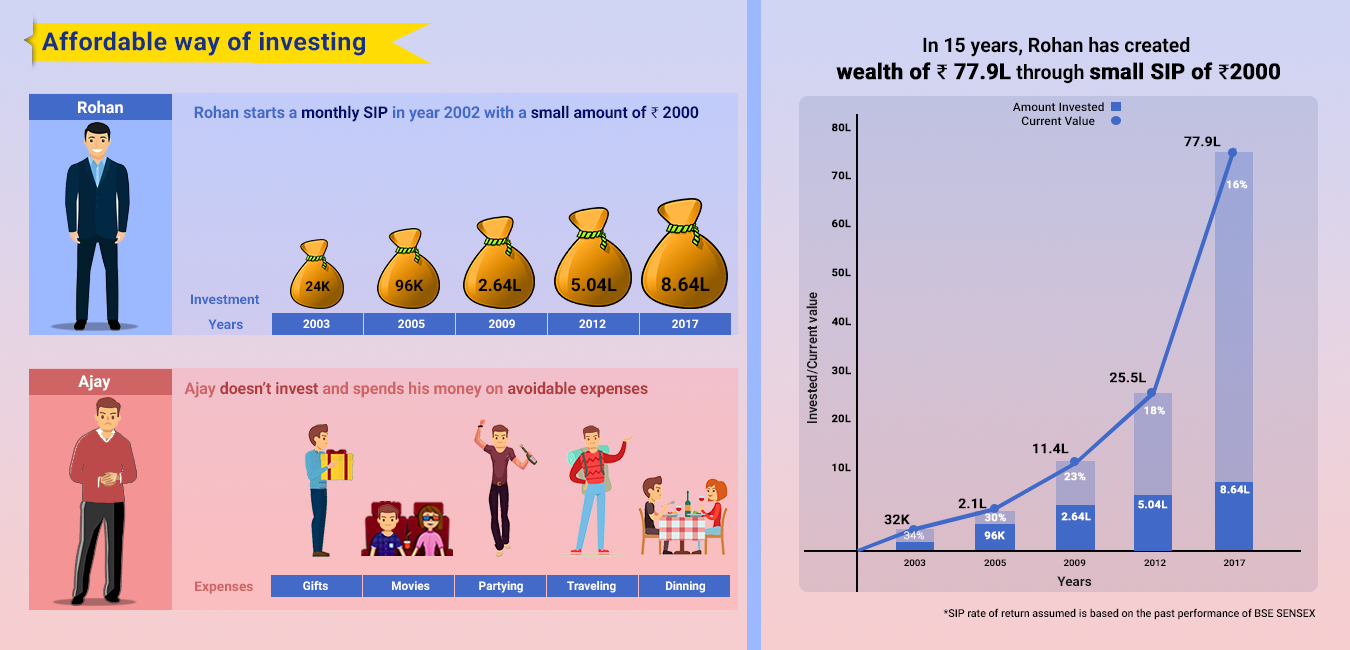

SIP is an effective tool which allows you to invest into selected Mutual Fund at fixed intervals (typically monthly).

-

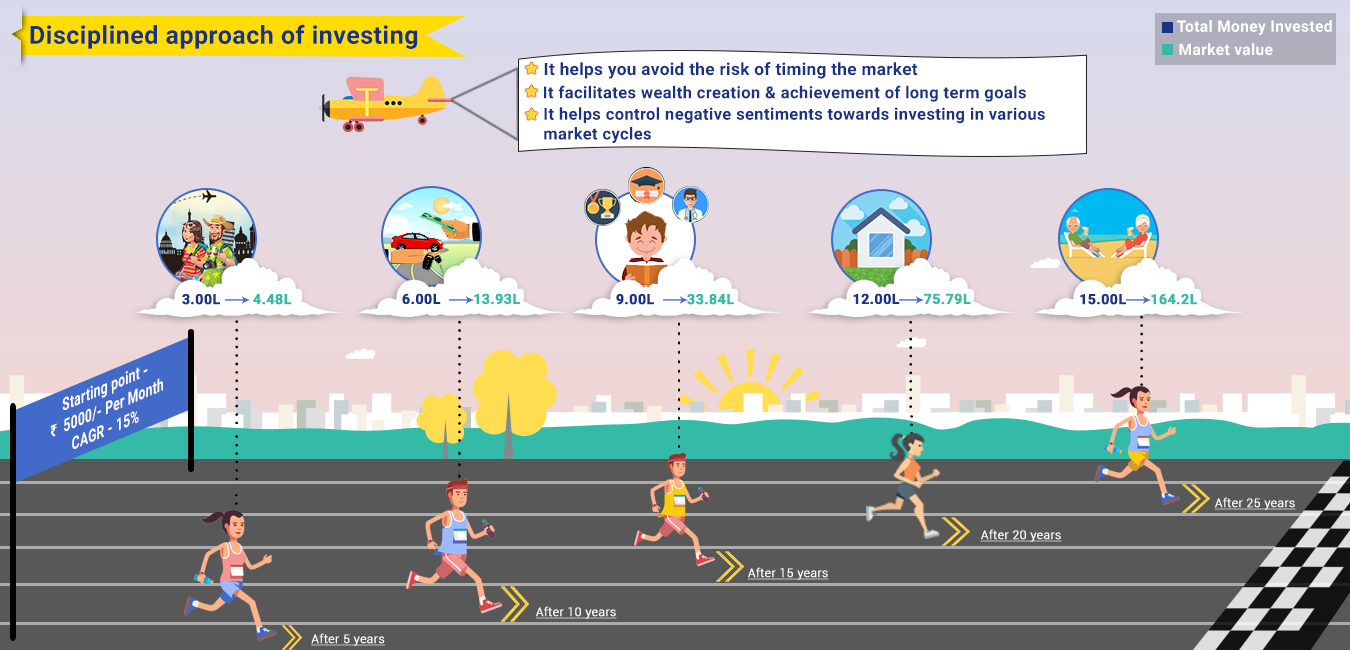

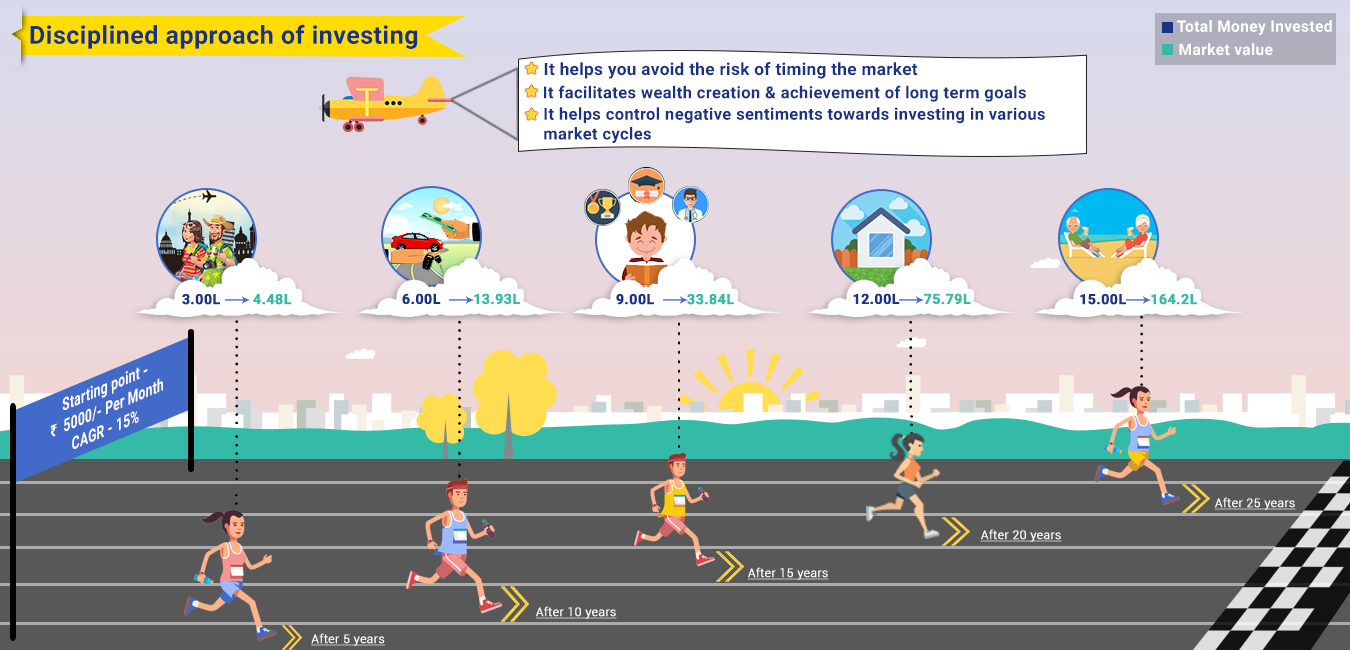

SIP helps to invest across highs and lows of the market in a disciplined manner without the worry of when to buy and sell or timing the market.

-

SIP has the potential to beat inflation and helps in long term wealth creation.

-

At RBL Bank, we help our customers to carry out mutual funds transactions seamlessly on INVEST FIRST++ Customers enjoy the hassle free experience of managing their mutual fund investments online.

Mutual Fund Calculator (SIP/One Time)

One-time Investment Amount

₹ 5000

₹ 100000000

I will keep the money invested for

12 Months

300 Months

I expect my investments to grow annually by

1%

50%

|

Value of amount invested (at maturity) ₹ |

|

Principal amount invested ₹ |

|

Interest earned ₹ |

| Start Investing |

*Terms and conditions apply. | For detailed information, click here

How Will it benefit you?

Systematic Transfer Plan (STP)

-

Systematic transfer plan or STP allows investors to periodically transfer a certain value of investment or number of units from one scheme to another scheme of the same mutual fund house.

-

Thus, at regular intervals a pre-determined value of investment or number of units is redeemed from one mutual fund scheme and is invested in another.

-

This allows investors to gradually shift investments from one scheme to another or one asset class to another.

Systematic Withdrawal Plan (SWP)

-

SWP is the periodic withdrawal of a fixed amount of money from the invested corpus at pre-defined intervals. It’s a convenient way to draw down one’s holding over the period of time.

-

Through SWP investor can reinvest the redeemed cash in another portfolio or use it as a source of regular income.

Personal Banking

Personal Banking  Corporate Banking

Corporate Banking  Prepaid Cards

Prepaid Cards  Credit Cards

Credit Cards Debit Cards

Debit Cards